Managing Editor, Features

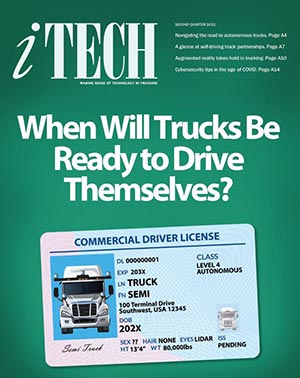

When Will Trucks Drive Themselves?

[Stay on top of transportation news: Get TTNews in your inbox.]

The road to autonomous trucking is long and littered with obstacles, but developers of self-driving systems for commercial vehicles are making clear and tangible progress in their mission to bring this technology to market.

The expanding roster of tech companies competing in this emerging field are not just attracting investors. They are also hauling freight for major shippers, partnering with motor carriers and forging alliances with vehicle manufacturers to produce purpose-built autonomous trucks in the years ahead.

Through those partnerships, technology developers such as Waymo, TuSimple, Aurora and Plus are building the necessary ecosystem to support autonomous operation while they continue to test and validate their automated driving software and sensor arrays on public highways.

Waymo tests its fifth-generation Waymo Driver on a Class 8 truck. Waymo is transferring software and sensors from its self-driving cars to its trucking division. (Waymo)

These companies, among others, have set their sights beyond the driver-assist technologies that already are available on Class 8 trucks.

Instead, autonomous truck developers are paving the way for SAE Level 4 automated driving, meaning the vehicle would be capable of driving autonomously without human input or backup, at least under certain conditions.

For now, their self-driving test trucks still have a safety driver behind the wheel while running on public roads, but the end goal for most of these companies is unmanned operation.

However, that doesn’t mean the technology would render professional truck drivers any less essential than they are today.

Fleets that are investing in this technology envision driverless trucks as a new service offering that will complement the industry’s workforce rather than displace it.

That’s because driverless trucks won’t be able to go everywhere or handle every load. They will be designed for specific applications that are best suited to automation, while professional drivers would continue to handle the many routes and freight categories that aren’t a good fit for the technology.

RELATED: Some Self-Driving Truck Developers Make Case for Supervised Autonomy

For U.S. Xpress CEO Eric Fuller, the deployment of autonomous trucks is not a question of if, but when.

“I think it’s going to happen,” he told Transport Topics. “I think the question mark still even today is the timeline.”

U.S. Xpress is among the first trucking companies involved in the testing and development of self-driving trucks. For the past few years, the truckload carrier has been working with TuSimple, which is using its test fleet to haul freight for some U.S. Xpress shipper customers on select lanes.

“It’s very small volumes, but we anticipate over the next three to four years ramping that up significantly, and hopefully by 2024 or 2025 actually operating autonomous units ourselves,” Fuller said.

He does not see this technology as a threat to the trucking industry’s workforce.

“We have a core group of drivers that are career truck drivers, and those drivers are not going to be affected by this in any form or fashion,” Fuller said. “They’re going to be able to make a living just like they do today.”

Instead, he sees potential for autonomous trucks to help reduce the industry’s high rate of driver turnover, particularly among new hires who too often exit the industry just months after entering it.

“Hopefully by having this type of technology, we can minimize the need for that type of churn, but the true career truck drivers are not going to be impacted negatively,” Fuller said.

U.S. Xpress Enterprises, based in Chattanooga, Tenn., ranks No. 24 on the Transport Topics Top 100 list of the largest for-hire carriers in North America.

Werner Enterprises is another major fleet helping to steer the direction of this technology through its partnerships with TuSimple and Embark, another self-driving truck company.

Leathers

Even as autonomous driving technology continues to advance, the freight transportation business will need more truck drivers in the future, not fewer, Werner CEO Derek Leathers told TT.

American Trucking Associations has estimated that the industry will need to hire 900,000 drivers over the next decade.

“I think that’s something that’s important for the industry and for drivers to understand,” Leathers said.

He compared the emergence of autonomous trucking to the rise of rail intermodal operations.

“There was all kinds of fear when intermodal really started to gain traction that it was going to decimate the trucking industry,” Leathers said. A couple of decades later, however, there are more truck drivers out on the road than there were back then, despite the growth of intermodal freight.

Leathers sees autonomous truck deployment playing out in a similar fashion as economic growth generates more freight and the need for more truck capacity, which will be supplied by traditional truck drivers as well as local and regional drivers working in conjunction with autonomous networks.

“I think there’s going to be a blending of labor productivity with tech productivity to lead to a more efficient outcome long term, but along the way, a need for even more drivers,” he said.

Werner Enterprises, based in Omaha, Neb., ranks No. 16 on the for-hire TT100.

Even after driverless trucks become commercially available, it will take time for deployment to scale up. The first autonomous trucking operations will begin as a tiny sliver of the total industry, and then expand — in terms of freight volumes and capabilities — over the course of years and decades.

Waymo conducts much of its self-driving vehicle operations from its facility in Chandler, Ariz. The company now offers fully driverless passenger car rides in the area. (Waymo)

People often underestimate the technical challenges and complexity associated with autonomous vehicle development, said Boris Sofman, head of engineering for the autonomous trucking program at Waymo.

“Just like any other massive and transformative technology, it takes decades to evolve and really grow into its full form,” Sofman said. “And that also is something that’s exciting because it means that there’s always new challenges on the horizon.” Although most of the early development work on autonomous vehicles centered on passenger cars, a significant portion of that energy now has shifted to commercial trucking.

Aurora Innovation, for example, is developing self-driving technology for multiple applications, including passenger mobility, but the company has made trucking its first priority.

“We’re starting out with autonomous trucking because we really think that’s where we could have the biggest impact — and the fastest — with the Aurora Driver, and really deliver the benefits of the technology safely, quickly and broadly,” said David Maday, vice president of global business development.

He said driverless trucks can help the trucking industry address pressing business concerns such as the driver shortage and high turnover. Autonomous trucking also will make it possible for fleet operators to haul freight without being constrained by driver hours-of-service limits and benefit from better, more predictable fuel efficiency.

“Driverless trucks are going to be a complement to the transformation and the continued evolution of the logistics services industry,” Maday said.

Autonomous Operations

U.S. Xpress’ Fuller said autonomous trucking will make sense for some lanes, but many types of freight will continue to need drivers for the foreseeable future — especially loads that require driver interaction.

A worker checks a lidar sensor on a self-driving TuSimple test truck pulling a U.S. Xpress trailer. (U.S. Xpress Enterprises)

“I look at this as a service offering that’s complementary,” Fuller said.

Initially, the technology will be a good fit for high-density longhaul freight lanes. As a result, early deployments of autonomous trucks actually may have a larger impact on the rail market than on trucking, Fuller said.

He also highlighted opportunities for longer haul expedited freight, especially in time-sensitive, coast-to-coast runs. Autonomous trucks could run around the clock because they won’t be constrained by driver hours-of-service limits.

Fuller envisions Level 4 trucks operating without a driver onboard. While drivers may remain in the cabs of self-driving trucks during an early testing phase, the business model for that level of automation ultimately will depend on going driverless rather than providing driver assistance, he said.

“From a financial cost perspective, the math doesn’t work with the driver in the truck,” Fuller said.

TuSimple is now trading on the Nasdaq stock exchange after the company raised $1.35 billion through its initial public offering in April. (TuSimple via Twitter)

Leathers said Werner does not foresee an opportunity in the next five years to deploy Level 4 trucks without a driver onboard due to the need for safety redundancy in the early stages. Over time, though, some hub-to-hub operations will naturally migrate in that direction, he said, if the technology reaches that point and the legislative and regulatory framework supports it.

“At some point, in some of the longhaul, hub-to-hub work, you’ll see some applications without a driver in the cab,” Leathers said. “But our focus right now is really on developing the safety technology that supports the drivers and the work that they do today, while keeping an eye open to the reality that technology develops very rapidly.”

Despite the recent progress in this emerging field, it remains unclear when autonomous trucks will be ready for prime time.

Given the complexity of autonomous driving and the many variables involved in its deployment, most self-driving truck developers hesitate to provide a specific timeline for launching their technology commercially.

One exception is TuSimple, which is working with truck maker Navistar to co-develop autonomous trucks targeted for factory production beginning in 2024.

The Road to Commercialization

As autonomous truck developers continue to accumulate miles on public highways with their test fleets, they are building more experience and paving the way for a commercial rollout.

More Q2 iTECH

But moving from the testing phase to deployment is no small step.

Waymo’s Sofman said there’s a big chasm between a great-looking autonomous vehicle demonstration and a commercial product that is ready for fully driverless operation.

Crossing that divide requires rigorous testing and development work to address rare, one-in-a-million-mile scenarios that the vehicle might encounter.

“Those are the things that really are the gate to go driverless,” Sofman said.

Waymo, which began in 2009 as the Google self-driving car project, already has learned those lessons with autonomous passenger cars.

After more than a decade of development work, Waymo began offering its fully autonomous ride-hailing service to the public in part of suburban Phoenix in October 2020. Within that specific geographic area, customers today can use a mobile app to call up a self-driving Chrysler Pacifica and take a ride with no driver on board.

In recent years, Waymo also has been applying its self-driving system to Class 8 trucks through its Waymo Via division.

Although an 80,000-pound fully loaded tractor-trailer is a far cry from a passenger car, much of the sensor capabilities, software development and artificial intelligence do carry over from cars to commercial trucks, Sofman said.

“What was really visible from the very beginning, and part of the core thesis of tackling trucking in parallel to bringing up the consumer transportation side of the business, is just how much reusable underlying technology is possible,” Sofman said. “A majority of what Waymo has been pushing on from the beginning is not about solving for an autonomous car, but fundamental technologies for autonomous driving.”

Waymo Via, which began as an early research and development project in 2017, is now testing self-driving trucks primarily in the U.S. Southwest and around its Mountain View, Calif., headquarters.

Sofman said the company plans to explore a mix of business models, including driverless trucks hauling freight between transfer hubs situated just off of the highway. Waymo Via also intends to add surface street functionality incorporating what it has developed in its passenger car business to navigate complex interactions with intersections and pedestrians.

To pave the way for driverless trucks, companies such as Aurora are refining their self-driving systems to manage the many rare and unexpected situations the vehicle might encounter on the road. (Aurora Innovation)

At launch, Aurora also plans to begin with driverless trucks operating in a transfer hub model. From there, the company intends to add surface street capabilities to enable depot-to-depot operation.

Aurora, founded in 2017 by self-driving vehicle pioneers from Google, Tesla and Uber, has offices in the Bay Area, Pittsburgh, Dallas and Bozeman, Mont.

Aurora recently expanded its operations by acquiring Uber’s Advanced Technologies Group, the ride-hailing company’s self-driving vehicles business.

That transaction, announced in December, more than doubled Aurora’s head count to about 1,600 employees.

Aurora and Uber also have announced a partnership to connect Aurora’s technology with Uber’s ride-hailing platform. In support of that agreement, Uber invested $400 million in Aurora, taking a minority stake in the company, and Uber CEO Dara Khosrowshahi joined Aurora’s board of directors.

In another recent example of consolidation in this emerging field, robotics company Nuro acquired self-driving truck developer Ike in December. Ike is working with fleet operators such as Ryder System, DHL and NFI to deploy Level 4 automated trucks on highways.

The technical challenges associated with autonomous truck development are very real, but only one piece of the puzzle.

For autonomous trucking to take off, the technology will require buy-in not only from shippers and motor carriers, but also from government regulators, elected officials and the motoring public, which will need to be comfortable sharing the road with these self-driving vehicles.

Safety will be paramount for all autonomous truck developers.

U.S. Xpress’ Fuller said a catastrophic accident involving an autonomous truck, even if it’s an exceedingly rare event, could set the entire field back significantly.

“It has to be almost perfect technology,” he said.

Partnerships With Truck Makers

Over the past year, several self-driving technology firms have announced partnerships with major truck manufacturers to co-develop autonomous trucks in North America and other markets around the globe.

In general, these partnerships are focused on closely integrating self-driving sensors and software with vehicle platforms at the factory level while introducing new components, such as redundant steering and braking systems, that developers deem necessary to safely enable driverless operation.

TuSimple has teamed with Navistar to produce purpose-built autonomous trucks, which the companies aim to build starting in 2024. U.S. Xpress has placed a reservation for “a couple thousand” of those vehicles to supplement its existing fleet, Fuller said.

TuSimple has a similar agreement in place with truck maker Traton Group to develop self-driving trucks in Europe, including plans for an autonomous hub-to-hub route in Sweden using Scania brand trucks.

Waymo, meanwhile, is collaborating with Daimler Trucks North America to develop a Freightliner Cascadia model piloted by the Waymo Driver.

Embark is designing its self-driving system to be compatible with several truck makes. (Embark)

Daimler also is actively developing Level 4 trucks with its subsidiary Torc Robotics, another autonomous vehicle pioneer. The truck manufacturer acquired a majority stake in Blacksburg, Va.-based Torc in 2019.

Aurora has formed partnerships with Paccar Inc. and Volvo Group.

Paccar said it intends to deploy Kenworth T680 and Peterbilt Model 579 trucks utilizing the Aurora Driver in the next several years.

Volvo Autonomous Solutions is working with Aurora to jointly develop on-highway autonomous trucks, starting with hub-to-hub applications in North America.

Embark has taken a different approach than some of its competitors by designing its self-driving platform to be compatible with trucks produced by all four of North America’s major original equipment manufacturers.

The company said its Embark Universal Interface incorporates self-driving components that will work across Freightliner, International, Peterbilt and Volvo truck brands.

The Cradle of Autonomous Trucking

The U.S. Southwest has become the premier incubation zone for autonomous trucking in North America, and arguably the world.

Although many of the companies developing this technology are based in Silicon Valley, they are conducting much of their testing and development work on interstate highways in Arizona, New Mexico and Texas.

In addition to ideal weather conditions and geography, developers also cite a favorable regulatory and political environment that makes those states conducive for Level 4 truck testing and eventual deployment.

The region also encompasses major truck lanes, including freight flowing from the Southern California ports to other locations across the country.

Like other developers, Waymo sees autonomous trucking eventually generalizing across the United States and globally, but the company’s “beachhead” has been the U.S. Southwest, Sofman said.

TuSimple’s fleet of about 50 trucks currently operates on interstate routes connecting cities in Arizona and Texas, but the company has outlined plans to expand its network across major shipping lanes throughout the country in the next few years.

Aurora’s initial deployments will be in the Texas Triangle, a major freight hub connecting Dallas, Houston and San Antonio.

Kodiak Robotics is expanding its self-driving truck operations with a new office in Texas. The U.S. Southwest has become a hotbed for autonomous truck testing. (Kodiak Robotics)

Kodiak Robotics, another autonomous trucking startup, is supporting its testing and freight operations from a new facility in the Dallas-Fort Worth area.

While the emphasis is on learning and building experience, some of these tech companies are simultaneously hauling freight for paying customers to offset some of their costs.

Along the way, self-driving truck startups have successfully raised funds to support their testing and development efforts.

TuSimple is the first developer of self-driving truck technology to become a publicly traded company. The tech developer raised $1.35 billion through its initial public offering in April.

“The investors that bought into our IPO, and the appetite for it, I think speaks volumes about the confidence that this is going to happen — that there are going to be autonomous trucks on our nation’s highways, and it’s going to be in the near future,” Jim Mullen, TuSimple’s chief legal and risk officer, said during an interview with TT at the time. Mullen, who joined TuSimple last year, previously was acting administrator of the U.S. Federal Motor Carrier Safety Administration.

TuSimple plans to demonstrate a fully driverless run on a depot-to-depot route in Arizona during the fourth quarter of this year.

The company, founded in 2015, is based in San Diego and operates facilities in Tucson, Ariz., and Shanghai and Beijing in China.

Automation and the Future of Trucking’s Workforce

Autonomous truck developers said driverless trucks can help address the trucking industry’s persistent driver shortage, which ATA has projected could reach more than 160,000 by 2028 if current trends continue.

U.S. Xpress’ Fuller, however, doesn’t see automation as a near-term solution to the industry’s labor shortage.

Fuller

“We have a really large need for drivers today, and I don’t see autonomous really making a dent in that in the next 10 years,” Fuller said. “Now, if we get 10-plus years out, then you could start to convert enough lanes where we could start to potentially have an impact.”

Automation also could improve driver recruiting and retention.

Fuller said autonomous trucks will be a good fit for high-turnover longhaul jobs that often require drivers to be away from home for weeks at a time.

“Those less desirable types of lanes and operating conditions are going to be the ones that will be automated first,” Fuller said. “One of the things that we really try to strive for is getting drivers home more often, giving them a more consistent schedule. I actually think this will help us accomplish that.”

Werner’s Leathers said the timing of autonomous truck development appears to be coinciding with people’s changing lifestyle choices and an increasing focus on work-life balance among younger generations.

Today, many veteran truck drivers really enjoy being out on the open road for weeks at a time, then taking extended time off, he said.

Even at Level 4 autonomy, self-driving trucks will have technical limitations. In this episode, we ask how technology developers are clearing those hurdles to make autonomous trucking a reality. We bring in Boris Sofman, head of engineering for the autonomous trucking program at Waymo. Hear a snippet above, and get the full program by going to RoadSigns.TTNews.com.

“They’re going to finish their careers doing exactly the kind of work they do today and like,” Leathers said, “but if you look at new entrants into the industry, there’s a much larger percentage of that population that really wants to work close to home and be home nightly, and if not nightly, weekly at a minimum.”

Over time, automation will naturally shift driver jobs more toward regional and local operations that match that growing preference for more home time.

“It’s really going to fit the need of the future driver without impacting the lifestyle of the current driver, just based on how the timing is currently projected to play out,” Leathers said.

Aurora also views driverless trucks as a way to improve the jobs of professional drivers by automating less desirable routes.

“It’s a tough industry. It’s got a lot of demands physically, mentally and emotionally,” Maday said. “We talked to plenty of companies, and we think this will be a really good enabler to get the right types of jobs and the right types of loads for drivers to carry, so maybe they are home on a more regular basis or even on a nightly basis with their family, and maybe they’re not so pressured to run all the routes they need to run right underneath the hours-of-service limitations.”

Although the timing remains elusive, the advent of autonomous trucking is beginning to come into clearer focus. The ongoing collaboration among tech developers, fleets, shippers and truck manufacturers will go a long way toward shaping this technology and how it ultimately will be deployed.

Want more news? Listen to today's daily briefing below or go here for more info: